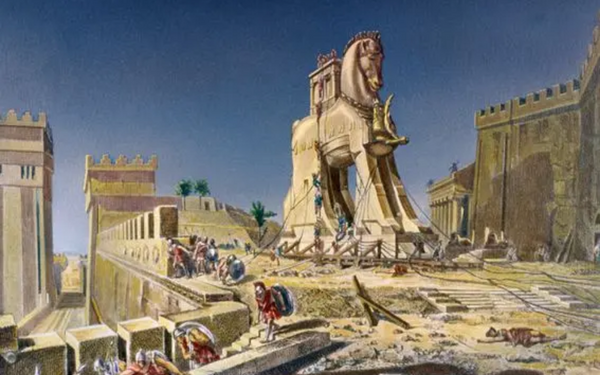

The globe as we know it now is largely a product of the efforts of the early explorers who defined the period now known as the Age of Exploration. The time witnessed the global dissemination of ideas and technologies, forever transforming the human experience. A new immersive future, one that merges physical and virtual worlds, is now being shaped by early explorers in the nascent phase of the metaverse.

The idea of private property in the virtual world, or metaverse, is crucial to this new era of discovery. Staking a claim in this brave new world requires securing the rights to own, control, and create novel augmented and virtual reality experiences within virtual worlds. Just as in the physical world, ownership is important in the virtual one.

Tim Cook, CEO of Apple, has recently shared his thoughts on why the metaverse has not taken off: “I’m actually not convinced the typical person can tell you what the metaverse is.” There is some truth to what he says. The common individual has a harder time making sense of the word “metaverse” when competing companies provide their own versions of the concept.

You don’t have to give it too much thought; the metaverse is just another dimension. Rather of being determined by a single company or creator, the future of the metaverse will be determined by the things that people do and create in this virtual 3D environment. Instead of placing faith in a single company’s vision, a “open” metaverse encourages and facilitates the involvement and contribution of all users.

We need a metaverse that is accessible to everybody, as the future of the virtual world should not be contained inside the boundaries of any single corporation. Users should be able to freely engage with one another, build and govern their own virtual worlds or experiences, and do so on whatever platform they choose to access the metaverse. People’s apprehensions about joining a closed metaverse can be allayed if they are given a hand in creating these new settings. Shares of Meta fell 73% in 2022 as investors worried the business was frittering away tens of billions of dollars in its pursuit to “possess” the metaverse.

Enhancing life rather than evading it

The potential of the metaverse as a whole has been called into question due to this sort of conjecture. Those working in the field must provide evidence for the value of virtual worlds, demonstrating their practicality and the entertainment they can provide. Improving players’ ability to get fully immersed in the metaverse is a key area for development. Metaverses that aim to bridge the gap between our virtual and physical realities by generating a digital duplicate of the world have a distinct, more grounded appeal than those that just create a fantasy world to escape to.

Instead of providing a refuge from reality, this interpretation of the metaverse works to improve it. There is a wide variety of potential applications, from providing a virtual tour of a company’s new building to distant employees to allowing both virtual and actual concertgoers to witness the same event in the same area (in the case of mixed reality concerts).

Shifting Gears from the Virtual to the Social World

An open metaverse and 3D digital twin of Earth, neither produced or controlled by a monopolistic body, are made feasible by the idea of spatial ownership. Those who take advantage of spatial ownership in the metaverse might claim their very own piece of real estate online. Non-fungible tokens (NFTs) are used, and each NFT represents a single, immutable digital asset that may be owned by only one person at a time. Users can purchase NFTs in the metaverse that are tied to specific plots of land, thereby giving them legal title to that property.

Buying a web domain nowadays is analogous to acquiring physical space in the metaverse. Just as some people invest in real estate in the hopes of reaping profits in the future, others purchase domain names speculatively in the hopes of profiting from the future popularity or uniqueness of a given URL. On the other hand, some people buy to finally feel like they own their own tiny corner of the Internet. Most businesses require a domain name, and many companies will want to secure the same or a similar one, making domains a commodity analogous to prime real estate. The best domain name will help a company gain the most online exposure possible in its particular field.

These ideas may be used in Web3 to allow users to claim ownership over specific locations inside digital worlds. Users may purchase NFT land much like a website domain, giving them complete ownership of an area in the metaverse and the ability to create their own custom environments there. Virtual versions of well-known landmarks and hotel chains are already being purchased and mapped by early metaverse explorers. This gives them the legal right to create, distribute, and/or sell material within the virtual areas, as well as the option to purchase the real land from its current owners.

Overcoming a mental roadblock

The open metaverse based on spatial ownership will likely face criticism, but there are many reasons to be optimistic about its long-term appeal. Our minds are hardwired to analyse spatial relationships. The limitations imposed by two-dimensional data on the brain’s processing power and breadth are well-documented. The natural progression of human information intake is from the two-dimensional internet to the three-dimensional augmented and virtual reality metaverse.

Furthermore, the success of the metaverse as envisioned here does not depend on a single organisation, but rather will be shaped by its users into the form that we collectively decide upon. Now, in the metaverse, the era of adventure is being rekindled. In order for us to create and contribute to the mixed-reality experiences that will define the future phase of our reality, it is the responsibility of metaverse firms and platforms to provide the virtual space and tools necessary to do so.

Subtly charming pop culture geek. Amateur analyst. Freelance tv buff. Coffee lover