In only a few days, the OnePlus Pad will have its official release and reveal. Now, thanks to a recent leak, we have our best look at the Android tablet yet, despite official announcements to the contrary.

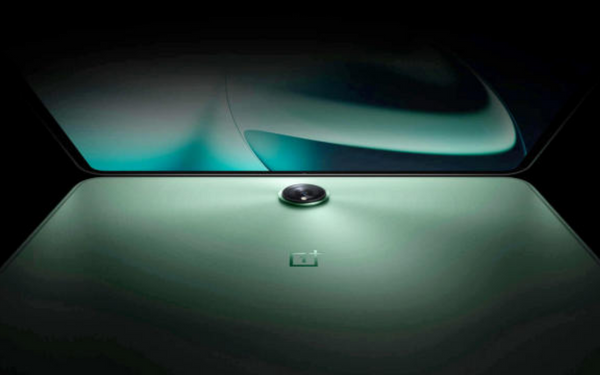

The image, shared by the always-reliable Evan Blass, reveals the tablet’s whole back and a sizable portion of its front. The Halo Green finish complements the obvious OnePlus logo and somewhat substantial camera hump.

The first official photo of the OnePlus Pad was shown in a TechRadar exclusive, and the leaked photo is a dead ringer for it. However, this second picture does show us the gadget in its entirety from a more clear perspective.

Facts and mysteries

We don’t know much about the OnePlus Pad just yet, such as how much it will cost or what features it will offer (there have been rumours about internal specs, but nothing is official so far).

We anticipate a sturdy tablet since OnePlus has said that it would be made with aluminium alloy and include a cambered frame. Also, there’s that Halo Green hue, which may or may not be exclusive.

As always, we will bring you all the news as it happens during the OnePlus launch event on February 7. On the same day, OnePlus will unveil the OnePlus 11 to the rest of the world.

More tablets running Android, please

We’ve stopped keeping track of the number of Apple iPad models available at any particular time of year, but there haven’t been many options for Android tablets in recent years. As opposed to other tablets, the Samsung Galaxy Tab S8 stands out as an exception.

Many Android applications aren’t designed with bigger displays in mind. Given the relatively low number of active tablet users, this becomes a self-fulfilling prophecy: fewer tablets equals fewer tablet app updates.

However, there have been successful Android tablets, such as the Google Nexus 7 from some years ago and the inexpensive Amazon Fire tablet series, which includes the most current Amazon Fire HD 8. If they’re reasonably priced, Android tablets have potential.

We’re keeping our fingers crossed that Android tablets will have a renaissance with the release of the OnePlus Pad and the forthcoming Pixel Tablet from Google. There is no reason why these gadgets can’t compete with iPads in terms of productivity and media consumption.

Subtly charming pop culture geek. Amateur analyst. Freelance tv buff. Coffee lover