Developer Zhuowei Zhang has released a useful app on Github that allows users to temporarily “overwrite” the iOS system font with another one, giving their iPhone a new, non-Apple-sanctioned look. This is great news for anyone who loves their iPhone but hates the San Francisco typeface.

To run, you’ll need “iOS 16.1.2 or below,” as the app takes advantage of a kernel execution bug (CVE-2022-46689) that was patched in iOS 16.2. Jailbreaking isn’t necessary to use the app. You won’t be able to try out the hack if you’ve already upgraded to iOS 16.2, which is highly recommended for security reasons. Restarting the device will restore the original font, and apps that don’t use the default San Francisco font will remain unchanged.

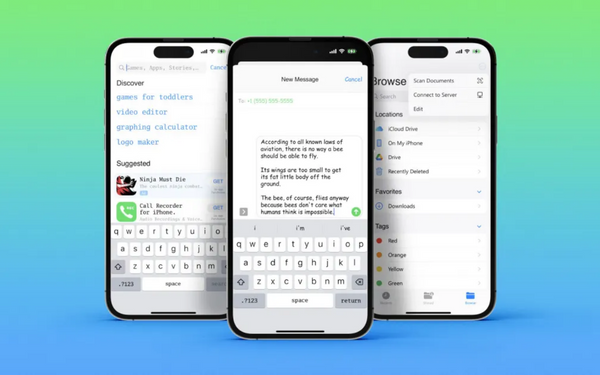

The app comes with a selection of fonts installed by default, many of which appear tailored to the chagrin of Apple’s user interface designers. While Comic Sans MS is by far the most common, you’ll also find fonts like Segoe UI (Windows and Microsoft’s default) and Samsung’s “Choco Cooky,” a close relative of Comic Sans. You can instal any custom fonts you like, so long as they are compatible with iOS.

Back in the classic Mac OS days, users could alter the look of their desktops down to the pixel by using the Appearance Manager to change everything from the system font to the window borders. Since Apple has taken more and more measures to protect system files from modification and tampering in recent years, reverting to a previous appearance of any of their operating systems has become increasingly difficult, starting with their original appearance being lost in the first releases of Mac OS X. (benign and otherwise).

Using a consistent font in your interface design makes testing simpler and prevents users from causing issues by employing a non-standard monospaced typeface that leads to rendering problems. These screenshots, however, make me wish that OS developers would once again give me control over such matters.

Subtly charming pop culture geek. Amateur analyst. Freelance tv buff. Coffee lover