Last night, on HBO and HBO Max, “The Last of Us” debuted for the first time. HBO said today that the series premiere was watched by 4.7 million people in the United States, making it the network’s second-largest debut behind the premiere of “Boardwalk Empire” more than a decade ago, which was seen by 4.81 million people. With over 10 million people, the premiere of “House of the Dragon” is still HBO’s most successful.

With an already-established fanbase, a stellar cast, and a faithful depiction of the property, the video game adaptation was bound for success. The audience numbers indicate that HBO is onto something with “The Last of Us,” however it’s too soon to tell if the show will become the most successful game-based TV series. The adaptation of “The Last of Us” marks the first time the production studio has worked on a programme based on a video game.

In a statement, HBO and HBO Max Content Chairman and CEO Casey Bloys expressed his excitement at seeing fans of both the show and the game enjoy this classic tale in a new format.

We’ll also mention that third-party app intelligence estimates from data.ai suggest that there was a 69% spike in first-time U.S. downloads of the HBO Max app across iOS and Android devices after the launch (previously App Annie). Also, on the night of the launch, the HBO Max app for iPhone was ranked #4 in all free apps in the U.S. App Store. The launch of “House of the Dragon” in August 2022 was the last time it was this high in the leaderboard.

Competition from other game-inspired programmes like “Arcane,” based on “League of Legends” and available on Netflix, is fierce for “The Last of Us.” The week of November15,2021, saw 38.4 million hours of “Arcane” being watched on Netflix. The international premiere of “Halo” on Paramount+ was the most viewed series debut in the service’s history. Amazon Prime Video is developing video game adaptations, including a “God of War” series based on the popular video game franchise.

The Sunday-streaming HBO original series will consist of nine parts.

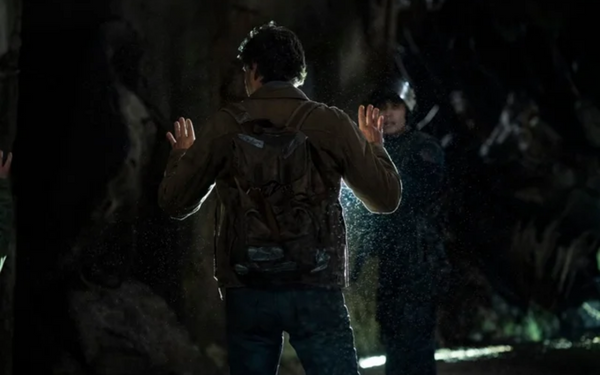

Frank (Murray Bartlett), Bill (Nick Offerman), Kathleen (Melanie Lynskey), Florence (Elaine Miles), Riley (Storm Reid), Perry (Jeffrey Pierce), and Henry (Trevor Morgan) were only a handful of the characters presented to HBO Max subscribers in the pilot episode (Lamar Johnson). The use of clickers will also be revealed for the first time to viewers.

Subtly charming pop culture geek. Amateur analyst. Freelance tv buff. Coffee lover