Whether they like it or not, new Samsung Galaxy S23 series owners will have to utilise Adobe Lightroom as their exclusive RAW picture editor.

With the agreement announced at Samsung Unpacked, Lightroom will be compatible with Samsung’s Expert RAW camera app. A few touches on a mobile device is all it takes to transfer photos to Adobe’s library management system.

Still, there is a little catch. The users will be urged to use Lightroom, but they won’t be compelled to. For the Galaxy S23, S23 Plus, and S23 Ultra, however, the app will be “the default and sole picture editor,” as described by Adobe’s chief product officer and executive vice president, Creative Cloud, Scott Belsky. Agreement between Samsung and Adobe Tell me what’s different and why it’s different.

The businesses expect that by integrating the Samsung Camera app with Lightroom, users will no longer have to deal with the hassle of downloading RAW photographs from their smartphones to an editing programme that is capable of working with the uncompressed data.

RAW files, the standard format for professional photography, allow for the capturing of high-resolution images rich with authentic colour and detail. Managing and organising photographs, however, may be an insurmountable slog for most mobile photographers due to large file sizes and a lack of support for RAW processing in all but the finest Adobe Lightroom equivalents.

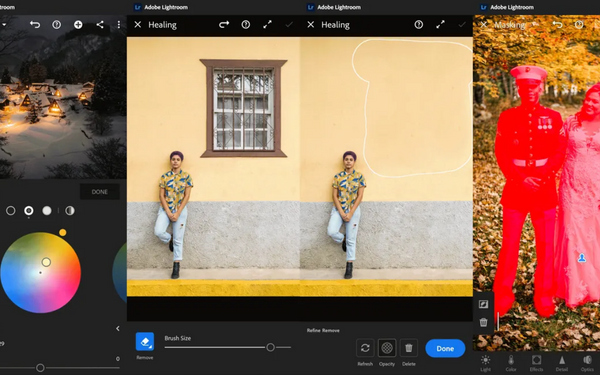

Lightroom’s addition to the Galaxy S23 has several useful features, including improved cloud backup and what Adobe awkwardly dubs “AI-powered professional, Photoshop-class editing capabilities.” Although a Creative Cloud membership is required to use Lightroom’s premium features on desktop, mobile, and web platforms, the mobile app itself is free to download and use. To sweeten the ‘default’ offer, Samsung includes a free two-month trial of Lightroom with its G23 line of cameras.

Samsung’s executive vice president and head of visual SW R&D, Mobile Experience Business, Joshua Sungdae Cho, said, “Samsung is proud to offer a suite of tools on the Galaxy S23 series that differentiate Galaxy users’ photography experiences, featuring Lightroom as the default Expert RAW editing tool for our Galaxy smartphones.”

With “Expert RAW” and “Lightroom’s sophisticated but accessible editing tools, presets, and tutorials,” anybody can create “professional-level modifications” to their photographs, as stated by Belsky.

As previously reported, Samsung has verified that Expert RAW photos captured on Galaxy S23 handsets may be automatically transferred to the Samsung Galaxy Book3 Ultra and Samsung Galaxy Book3 Pro series.

Subtly charming pop culture geek. Amateur analyst. Freelance tv buff. Coffee lover